期货顶部反转(期货反着做)

Understanding Futures Top Reversals in Trading

In the world of futures trading, top reversals play a crucial role in indicating potential shifts in market direction. Recognizing and interpreting these patterns can provide valuable insights for traders looking to make informed decisions. This article delves into the concept of futures top reversals, how to identify them, and their significance in trading strategies.

Key Characteristics of Futures Top Reversals

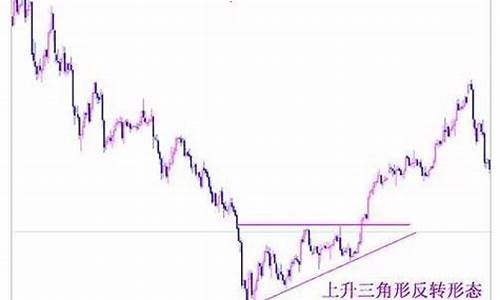

Futures top reversals occur when an asset's price reaches a peak and begins to decline, signaling a possible trend reversal from bullish to bearish. This pattern is often marked by a series of higher highs followed by a lower high, indicating a weakening of buying momentum. Traders typically look for signs of exhaustion among buyers at these levels, such as long wicks or increasing selling volume.

Identifying Opportunities with Futures Top Reversals

When traders spot a potential top reversal in futures markets, it presents an opportunity to consider taking short positions or adjusting existing long positions. Confirmation of a top reversal often comes with the break of key support levels or the formation of bearish candlestick patterns. Utilizing technical indicators like moving averages or oscillators can help validate these signals and enhance trading decisions.

Conclusion

In conclusion, understanding futures top reversals is essential for traders looking to navigate volatile markets and capitalize on potential trend reversals. By staying vigilant for key signs and patterns, traders can position themselves strategically to take advantage of market opportunities. Incorporating risk management techniques and staying informed about market developments are also vital for successful trading strategies in futures markets.